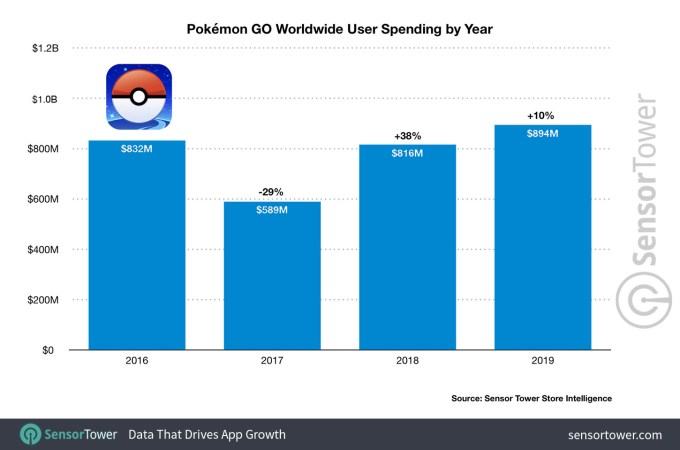

For many gamers, Pokémon GO was an exciting fad that ate up their summer and was just another chapter in a franchise. A lot of these people would already treat the game like some sort of nostalgic mid-2010s hit, but the game is minting cash from users at a more expansive rate that ever. A report in Sensor Tower this week estimated that 2019 was Niantic’s best year to date in terms of in-app purchase revenue from Pokémon GO users, noting that the company likely pulled in nearly $900 million according to its estimates.

The rate of user revenue is still lower now than it was following launch, Pokémon GO launched in just a few markets at the beginning of July 2016 and Sensor Tower estimates its revenue reached $832 million in the final six months of that year. But with higher year-over-year totals compared to 2017 and 2018, the estimates do suggest that Niantic’s aggressive updates to gameplay and its in-game social features helped boost revenues.

The truth is, every couple years there’s a new gaming title that accumulates users at a startling pace. What happens after the press cycle churns and the game is left to its own devices is where the great studios prove themselves. Niantic is in a cushy position as its breakout title fills its coffers, but the company still has some soul-searching ahead of it as it simultaneously aims to chase a follow-on hit and a developer platform.

Delivering follow-up hits is a nearly impossible task which is why so many studios attempt to recapture lightning with a well-timed franchise sequel or spin-out. There are limits, but sometimes those limits are further out that expected, just look at Rovio. Or see a heavy hitter like King, which still rakes in stupid amounts of money from 2012’s Candy Crush Saga. The title pulled in a staggering $1.1 billion in 2019, Sensor Tower estimates, but you won’t see another one of King’s games close to reaching its success after all these years, its most popular follow-ups have still been Candy Crush Saga clones.

Niantic suffered a disappointing launch for its long-awaited Harry Potter: Wizards Unite title this year, which borrowed heavily from the gameplay style of Niantic’s other titles, but only generated an estimated $23 million in revenue this year.

Thankfully, maintaining and evolving a central cash cow enables a level of flexibility that can help studios bankroll their more creative longshot efforts. Investing in tech directly hasn’t been the most common next step for most mobile game studios, but Niantic’s Google roots have left its culture more tech-centered than most, something that has pushed it to invest heavily in AR for its own titles and its Niantic Real World Platform for developers. Mobile augmented reality has had major backing from tech’s top companies, but the platform has been slow to catch the attention of consumers.

There are plenty of formulas for success in the gaming world these days. Mobile gaming has fundamentally shifted the staying power of titles and how those titles rake in cash for studios. This impact was minted on phones but is consistent across mediums. Titles like Candy Crush have driven micro-transactions while strong single-player franchises have transformed into platformized MMOs.

For titles like Pokémon GO, the challenge has been reinventing the game and driving higher revenues per user without corrupting the gameplay that brought people onboard in the first place. For Niantic, the challenge will be doing that while settling on a vision for its future that resonates with users or developers or both.